Thu Feb 05 2015. The SST has a smaller range of taxable items in comparison to the GST which was a wider range meaning that basically all goods and.

How Is Malaysia Sst Different From Gst

Its the first time since the Seventies when the Service Tax Acts 1975 that there isnt any kind of consumption tax imposed but as the government has been saying from the start it will end.

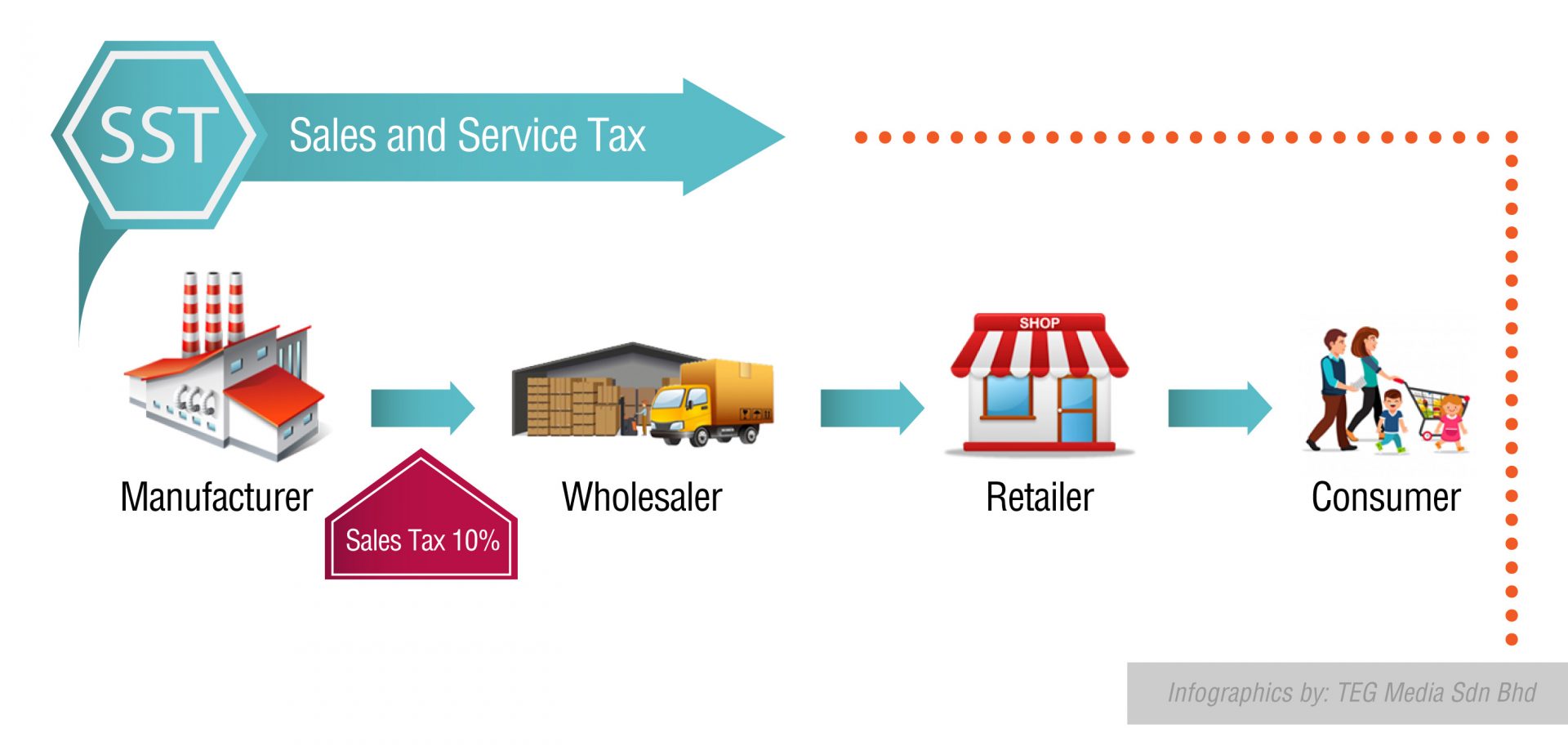

. A license had to be obtained if annual sales turnover exceeded RM100000. In effect it provides revenue for the government. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax.

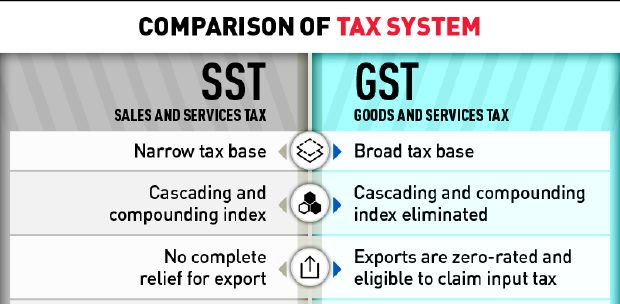

The differences between GST and SST. GST vs SST is an argument commonly heard among Malaysians especially during the initial roll-out phase of GST in 2014-2015. It was replaced with a sales and services tax SST on 1 September 2018.

The move of scrapping the 6 GST has paved the way for the re-introduction of SST which will come into effect in 1 September 2018. Below is a summary of the points for taxpayers to consider during the transition period. Homefinder Malaysia Malaysians are currently enjoying a three-month tax break between the zero-rating of GST and the re-introduction of SST.

Putra Business School Manager of Entrepreneurship and Community Development and Impact senior lecturer Dr Ahmed Razman. Same intention to exclude DAs and Special Areas from sales tax. The Goods and Services Tax GST is better than the Sales and Services Tax SST as GST collection is more than the latter which benefits the government businesses and the rakyat as a whole said economists.

Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax imposed. Goods and services tax to sales and service tax transition rules. GST stands for Goods and Services Tax while SST stands for Sales and Service Tax.

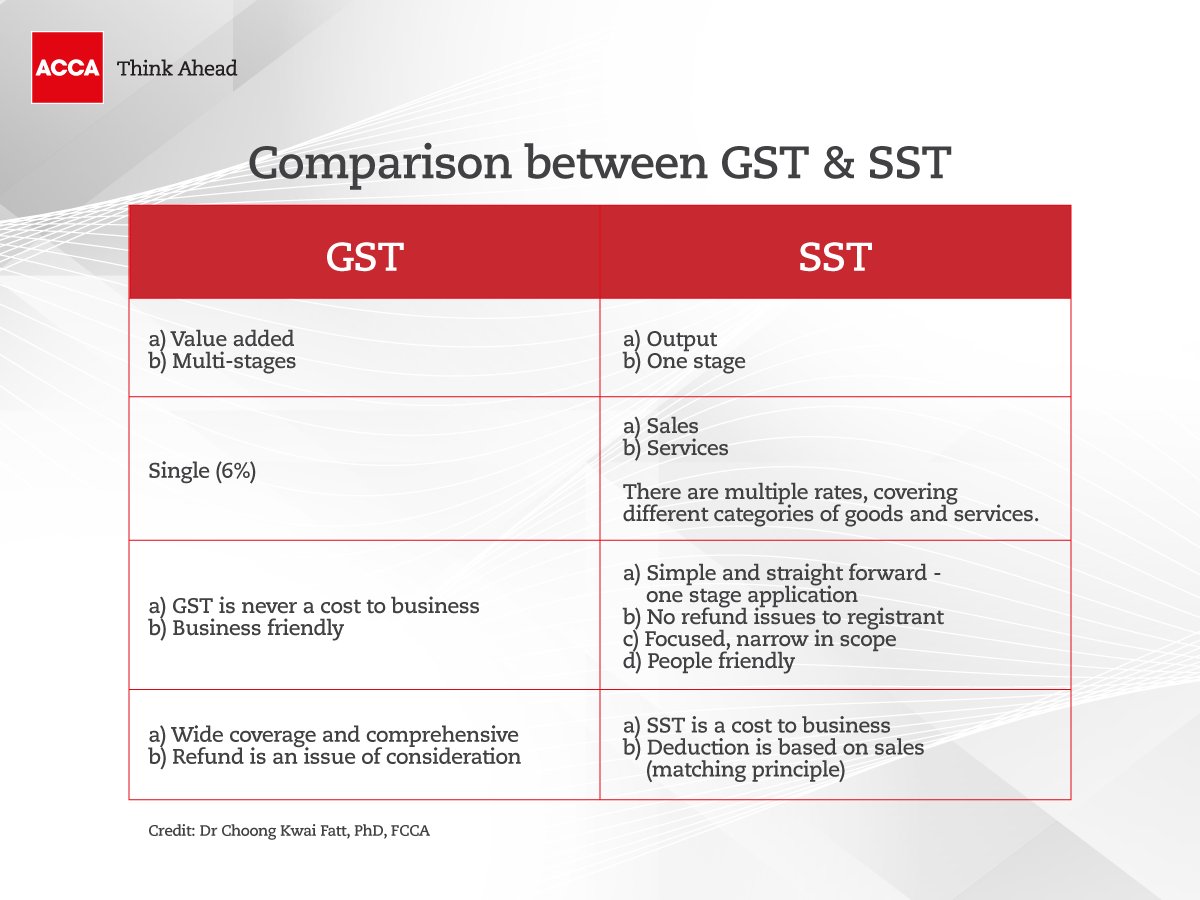

And 6 for services and GST standard rate of 6 are forms of a consumption tax in which SST is a single-stage tax while the GST is a multi-stage tax. This tax will be replacing the Sales and Services Tax SST which is a single stage of consumption tax where businesses cannot recover the tax paid on. The standard rate of tax.

How SST VS GST in Malaysia can be evaluated. Same goes for the GST although obsolete shortly after introduction it is also a taxation policy on most goods and services sold for regular consumptions. The battle between GST vs SST is real.

GST stands for Goods and Service Tax and is implemented in Malaysia starting from 1st April 2015 to replace SST. Mandatory registration upon reaching a threshold of RM500000 voluntary registration also possible Sales Tax. Consumers will have a choice in their consumption by paying service taxes based on their.

In conclusion we all now know that the SST 10 for sales. On the 1 June 2018 the new Malaysian government withdrew the Goods and Services Tax GST. Goods and Services Tax GST is a form of multi-layer tax introduced by the Malaysian Government in 2014.

You need not to be part of any political divide to have an opinion on the Malaysian tax system because any sort of tax system. We are only few months away from the implementation of the much talked about Goods and Services Tax GST on April 1 2015. MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it will incur in most goods and services.

Places outside Malaysia There are two proposed new pieces of legislation not present in the previous SST regime namely Sales Tax Imposition of Tax In Respect of Designated Areas Order 2018 and Sales Tax Imposition of Tax In Respect of Special Areas Order 2018. It is applied to all level of the production chain refer to Figure 1 hence it is often referred as. Up to this day when this post is made people are still arguing and debating about it.

SST is a federal consumption taxation policy that falls under Sales Tax Act 1972 in Malaysia. Kaygarn No Comments. GST vs SST became one of the hottest debate topics among the politicians from the government as well as the opposition.

Certain supplies are treated as zero-rated exempt or are subject to relief. GST is a value added tax imposed on goods and services sold for consumers. Supplies made between 1.

Gst Vs Sst In Malaysia Mypf My

Comparing Sst Vs Gst What S The Difference Comparehero

Sst Vs Gst How Do They Work Expatgo

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst Better Than Sst Say Experts

Gst Better Than Sst Say Experts News Summed Up

Accamalaysia No Twitter As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize This Opportunity

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Gst Vs Sst Minding Your Business The Economics Society

Gst Better Than Sst Say Experts

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst Vs Sst In Malaysia Mypf My

Sst Vs Gst How Do They Work Expatgo

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic